An important history lesson for serious entrepreneurs

Since time immemorial, humans have sought ways to build trust, thereby enabling them to transact more cheaply in their move towards specialisation and away from subsistence. This need gave rise to barter, which in turn was replaced by money. With money, came the perceived need for a centralised authority to control that money. In ancient times this authority tended to be a king or the state, but since 1912 with the creation of the privately owned Federal Reserve in the USA and the privately-owned Bank of International Settlements, which regulates 125 (mainly privately owned) central banks, the issuance of money has largely been in private hands. These formal institutions grew so much that they now comprise 8% of global GDP and exert more control over the governments that regulate them. In this process they have moved from gold-backed currencies, to paper-backed fiat currencies, which like bitcoin are based on nothing more than a promise. When the internet arrived, they moved this process from paper online.

For much of the 20th century, fiscal discipline was maintained by the fact that central banks had to back their currency with gold – that is until 1968, when the Bretton Woods system started to collapse. After 15 August 1971, when Richard Nixon revoked USA’s commitment to the gold standard, the US Dollar has lost an average of 7% per annum vs gold since 1971.

Stay with us…this is important.

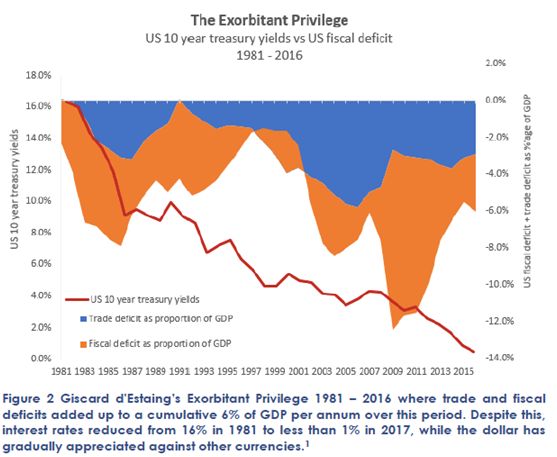

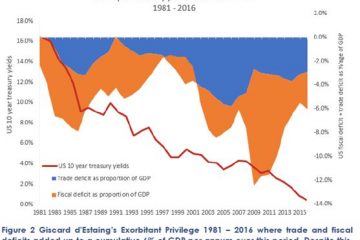

The dollar became a fiat currency, backed by only a promise and a distortion in the foreign exchange markets in what became known as the “Exorbitant Privilege”. The Exorbitant Privilege was a phrase coined by Valéry Giscard d’Estaing, the French Minister of Finance, at the time of the Bretton Woods collapse. He referred to the fact that as the US dollar became the world’s reserve currency, where key imports – notably oil and gold were pegged to the dollar price, the USA would never face a balance of payments crisis, as both its imports and exports were in a currency over whose supply its economy could create extra supply. Put another way, if the US wanted a barrel of oil, it could print US$50 to pay for it, whereas France needed to sell US$50 of French goods to buy the US$50 on the foreign exchange markets it needed to pay for the barrel of oil. Giscard d’Estaing predicted correctly that the USA would destabilize the world economy by running up vast current and fiscal account deficits that would eventually cause the global fractional reserve system of banking to collapse. (Sampson, 1968)

[accompanying doc page 19]

With the power to create money through a privately-controlled fractional reserve system, privately owned banks have accumulated unparalleled power over governments prompting Bill Clinton’s advisor, James Carville to say that if reincarnated, he would come back as the bond markets.2

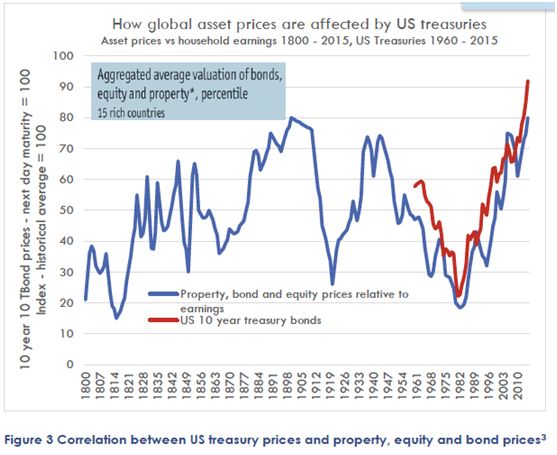

The problems of the fractional reserve system in private hands were exacerbated by Baby Boomers, those born between 1945 and 1965. These represent 60 million or 20% of the US population whose savings were put into pension funds as they saved prodigiously at their peak earning powers fuelling the stock market gains in the Great Bull Run between 1982 and culminating in the internet frenzy in 2000. From 2000, when the first baby boomers turned 55, pension rules stipulated that funds had to transfer from equities into bonds, driving bond prices up and with them, bond yields down. Lower interest rates, meant that each dollar of income could purchase more assets on borrowing, causing a global property boom. See below

As bond prices increased, reducing interest rates and therefore returns, bankers became more creative with the use of derivatives to separate credit risk exposure from the underlying loans. This contributed to the derivatives markets ballooning to $700 trillion in 2008, where over $400 trillion were interest rate based derivatives.

The extent that these bankers were out of control became apparent to the wider population in 2008, when despite almost $2 trillion being wiped from the US property market with the sub-prime crisis, a US government bailout worth $787 billion and the threat of a global banking collapse causing millions of jobs to be lost, not one banker was charged with fraud.

Regardless of one’s views on financial institutions, this analysis shows that it is increasingly difficult to adhere to the adage “Buy Low Sell High” in the current market. Figure 3 Correlation between US treasury prices and property, equity and bond prices shows that asset prices relative to household earnings are more expensive than at any time since the French Revolution.

0 Comments